Dear Friends,

Below are some recent activities and highlights taking place in the Idaho Capitol. We hope you enjoy the information. For more details, you can go to legislature.idaho.gov where you will find bills, committee recordings, and live stream videos of our House and Senate floor sessions. I appreciate your interest and involvement.

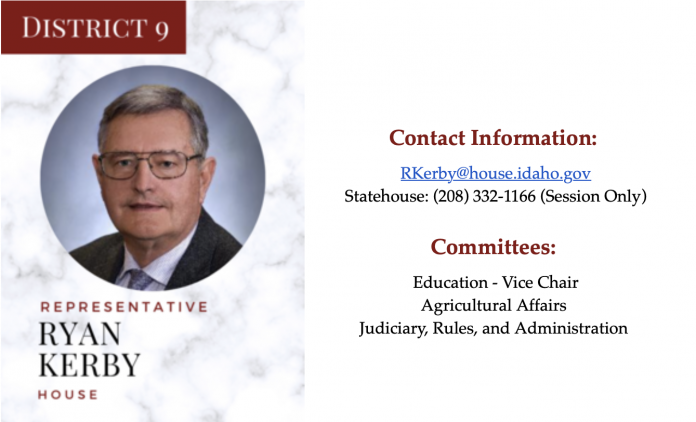

Sincerely,

Ryan Kerby

Legislature Continues Work On Groundbreaking Tax Reform

Several bills related to tax reform and tax relief have been introduced this week. The Senate Local Government & Taxation Committee voted unanimously Wednesday, January 26, 2022, to introduce the bill proposed by Sen. Regina Bayer (R-Meridian), regarding restrictions on the “circuit breaker” property tax break for needy seniors. The bill amends a bill passed last session in the House, which included provisions taking away the tax break for homeowners whose homes were valued at or more than 125% of the median value in their county. Senator Bayer’s bill proposes to boost that to 200%. Previously only income, age and disability criteria were used to determine the property tax break, not home value. This bill would restore protections to approximately 800 recipients. “These people need the help that has been offered to them in the past,” she added.

Senator Jim Rice (R-Caldwell) presented HB 436 to the Senate Local Government and Taxation Committee on Thursday afternoon. After hearing 13 people testify, the committee voted to approve the bill, which would include income tax cuts. Senator Rice stated, “This is a good step in making Idaho’s tax code more competitive. It still leaves us with the 10th highest income tax rates for our middle-class citizens – for our people that work for a living. One of the interesting things about a tax is that you can’t give tax cuts to people who aren’t paying taxes and you can’t give a tax cut that exceeds the amount of taxes that people pay.” HB 436 will now be considered by the full Senate.

Idaho Legislature Supports Educators By Improving Health Care Coverage Standards

On Monday morning, the Idaho Legislature passed House Bill 443, which will set up a fund to bring school district employees’ health care coverage standards in line with state employees. There has been a $4,100 gap between what is spent each year on state employees’ healthcare coverage versus what is spent on teachers’ healthcare coverage. This bill will help close that gap and make healthcare more affordable for Idaho’s school district employees. The bill’s lead sponsor, Representative Rod Furniss (R-Rigby), stated in regard to the gap, “for a decade we’ve been trying to get that up to where the state employees are, we just haven’t been able to do it or have the resources to do it.”

It sets up an account that would let school districts shift from their private health insurance plans onto the state’s self-funded insurance pool, contingent upon state funding. Rep. Furniss said the move could save employees hundreds of dollars a month on insurance premiums, since the state plan is far more affordable. “Most teachers right now have $1,000 to $3,000 deductibles, and most pay $600 to $1,500 per month,” he said. “Some teachers and staff end up writing a check at the end of the month back to the school, to pay for health insurance. I think we can do better.”

The bill passed the House with a 55-14 vote. Representative Julie Yamamoto (R-Caldwell) shared that, “as an educator of 32 years, I’ll tell you there has never been a harder time to be in education than there is right now. And it’s not just teachers – it’s also every other staff member who is working there.” Teachers play a vital role in the success of Idaho’s youth, and efforts will continue to be made to improve their conditions.

Fighter Wing Commander Shares Priorities and Strategic Briefing

Colonel Ernesto DiVittorio, Commander of the 366th Fighter Wing met with Legislators on Monday to share the Wing’s vision and mission. As the wing commander, DiVittorio leads over 4,000 military and civilian members, known as Gunfighters. The base supports 18 squadrons, including one comprised of members from the Republic of Singapore Air Force and one tenant unit. He will also be responsible for the F-15E and F-15SG fighter aircraft that are assigned to the base.

The 366th recently activated two Fighter Generation Squadrons, to realign with the Combat Oriented Maintenance Organization model. This model enhances the Gunfighter’s ability to be better postured for dynamic force employment in support of Department of Defense priorities.

Col. DiVittorio shared the Fighter Wing’s priorities and had shared that, “we are on the leading edge and it takes every single one of us to continue to propel the Gunfighters, the U.S. Air Force, and the United States forward. Airpower is a team effort, I look forward to leading this high-performing team as we move forward together.”

Legislature Grapples With Change In Employee Compensation

On Wednesday, the Legislature’s joint Change in Employee Compensation Committee, chaired by Senator Jim Patrick (R-Twin Falls) and Representative James Holtzclaw (R-Meridian), defeated by narrow margins the five motions put forward for consideration. They each either equaled or exceeded Gov. Brad Little’s recommendation of a 5% increase in state employee pay, 2% across the board and 3% for merit raises. After all, but one, failed on 5-4 votes, the committee agreed to come back and try again next week. Inflation in the Mountain West is currently the highest in the nation at 8.6%. The Committee noted the importance of the issue and will be back at the table next week to continue discussions.

Joint Finance-Appropriations Committee Discussed Wildfire Mitigation

As the Joint Finance-Appropriations Committee continues budget hearings, the Idaho Department of Lands is looking at a 20.7% increase in state general funds, or $1.5 million, largely to enhance wildfire response on state-protected lands. Director Dustin Miller told JFAC, “The volume and the shortage of resources caused many fires to escape initial attack.”

Miller said that Idaho needs to do more before fires start. With the right investments in fire preparedness, Idaho would be better equipped to stop fires when they are small, which would, in turn, save Idahoans tax dollars and create a safer environment for firefighters.

State of the Judiciary

Idaho Supreme Court Justice Richard Bevan delivered the annual State of the Judiciary address to the Idaho Senate on January 26, 2022. Justice Bevan opened his remarks by expressing pride in how well the courts have responded to the challenges of the past two years.

“As I’m sure you recognize, we have faced challenges in 2020 and 2021 unlike anything we have seen for a century. But through it all, because of the dedication of so many devoted people, the rule of law remains alive and well in Idaho.” He noted that Idaho judges held nearly as many court hearings in 2021 as in 2019, and did so safely.

Bevan spoke about other judicial priorities, including adding both judicial and administrative staff to courts around the state and continuing support for the work of the Idaho Behavioral Health Council.

Inflation has reached the highest level since 1982 as consumer prices jumped to 7% by the end of 2021, hitting a 39-year high in December. The price of food and energy rose the most and had the fastest 12-month gains in 13 years.

Fueled by faster monetary growth because of the Federal Reserve’s expansionary monetary policy, and slower output growth due to supply chain issues, work absences, and labor shortages for most of 2021. Bonus unemployment insurance payments amplified the issue leaving Idahoans feeling the impact of poor federal policies.

The federal government’s runaway deficit spending also bears responsibility for faster monetary growth, selling treasury bonds to finance spending, increasing government debt and spurring monetary growth and inflation.

Your Idaho Republican legislators are working to ease the burden of inflation by avoiding new taxes and leading with pro-growth principles, helping Idaho families and businesses who are seeing the value of their dollar shrink before their eyes.

HB 436: Income tax rebate; reduces independent and corporate income tax rate. House passed 57-13; Heard in Senate Local Government & Taxation Committee.

HB 441: This bill offers absentee ballot assistance for those in nursing care facilities by designating three authorized sources of voter assistance. Referred to House State Affairs.

HB 443: This proposed legislation will create a dedicated fund to bring school district employees’ healthcare coverage up to the same standard as that of state employees. The bill passed the House 55-14 and has been referred to the Senate Education Committee for a hearing.

HB 474: This bill will limit the maximum duration of county leases for courthouses or jails from 30 years to five. Introduced, and referred to JRA for printing.

HB 450: This proposed legislation will provide employers with unemployment insurance tax rate stability and consistency by extending the 2021 unemployment insurance base tax rate over a period of two years. Which will result in a tax savings of $64 million for Idaho businesses. Referred to House Commerce & Human Resources.

SB 1226: This legislation declares that Idaho students can be designated as self-directed learners, if they meet the criteria laid out in the bill. Referred to Senate Education.

SB 1239: This bill would require the legislative session to end on or before the last Friday in March each year, unless two thirds of each house votes to go longer. A similar bill was introduced last year, but died in the House. Introduced, printed and referred to Senate State Affairs.

SB 1241: This bill makes a change to Idaho Code by increasing the maximum value of a home that qualifies for the property tax reduction program (aka Circuit Breaker) to assist more low-income applicants to remain in their homes. Introduced, printed and referred to Senate Local Government & Taxation.

SB 1242: This bill creates The Empowering Parents Grant Program which will provide funding to parents to help meet their child’s educational needs and to address any learning loss with grants of $1,000 per student or a maximum of $3,000 per family for public and non-public students. Introduced, printed and referred to Senate Education.